How Homeowners Are Paying for Their Remodeling Projects

If you’re considering a home remodel, do you know yet how you’ll pay for it? There are several ways to fund a home renovation besides plain old cash — and the fact is, nearly half of homeowners use more than one payment method.

Houzz recently teamed up with two financial institutions, Synchrony and Bank of America, to do a deep dive into the ways homeowners paid for their home renovations in 2017. Read on to find out about the various renovation financing methods, plus which ones homeowners are choosing and why.

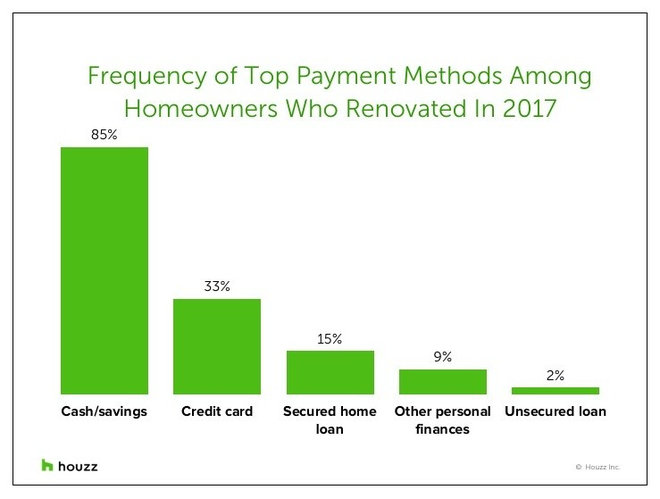

The main financing methods for home remodels are cash, credit cards, secured loans and other personal finances, according to the two Houzz studies — one focused on credit card usage in collaboration with Synchrony, and the other focused on secured financing with Bank of America.

Cash. This, of course, is the simplest method — you save up to pay for your home remodel with cash. It’s also the most common method: 85 percent of homeowners Houzz surveyed paid for 2017 home renovations with cash, according to the studies. However, only 54 percent of those surveyed used only cash or other personal finances (gifts or loans from family, for instance) as their sole payment method.

Credit cards. The options are store-specific cards and credit cards not tied to a specific store. The upside of this method is that you could earn rewards points, but the downside is potentially paying interest. (More on this later — some homeowners use credit cards with no or very low interest.) Thirty-three percent of homeowners Houzz surveyed used credit cards to pay for home renovations in 2017. “Credit cards are rarely used in isolation; most combine them with cash,” says Nino Sitchinava, principal economist at Houzz.

- HELOCs. Home equity lines of credit (HELOCs) are revolving lines of credit that can be taken out against your home equity. Essentially, you’re borrowing against the equity in your home, and the house is used as collateral for the debt. As you repay the balance, the line of credit is replenished, meaning you can borrow against it in the future. Seven percent of homeowners surveyed who renovated in 2017 used HELOCs to pay for their projects.

- Cash-out refinancing. This is a home mortgage refinance in which the new mortgage is for a larger amount than the existing mortgage, with the difference converted to cash for the homeowner. Five percent of homeowners surveyed by Houzz who renovated in 2017 used cash-out refinancing to pay for their renovations.

- Home equity loans. A home equity loan is a type of second mortgage that allows you to borrow against your home’s value. It may be a general loan, a construction loan or a home improvement loan. Four percent of homeowners Houzz surveyed who renovated in 2017 used home equity loans to pay for their renovations.

Other personal finances. This category includes other ways to pay for projects — for example, gifts, inheritances or loans from family. Nine percent of homeowners Houzz surveyed who remodeled in 2017 used other personal finances to pay for their projects.

Unsecured loans. These are loans that don’t require collateral. Qualifying for such a loan is based on your credit score and income, and of course there is interest that you must pay over the life of the loan. Student loans and personal loans that you can get from banks and credit unions are examples of unsecured loans. Only 2 percent of homeowners Houzz surveyed paid for 2017 home renovations with unsecured loans.

As mentioned above, one in three homeowners (33 percent) use credit cards to pay for their home renovations, typically in combination with cash or other personal finances. “A typical credit card user puts up to 25 percent of funds on the credit card,” Sitchinava says.

Homeowners ages 25 to 34 were most likely to use credit cards (41 percent), while those 55 and older were less likely (30 percent). Most homeowners who use credit cards to fund renovations pay off balances over time (62 percent) rather than immediately. Although that may not at first glance seem like a good idea from a personal finance perspective, the majority of those who are paying off balances over time have no-interest (58 percent) or low-interest (16 percent) promotional credit card interest rates.

Homeowners surveyed chose to use credit cards with nonpromotional interest rates for quicker access to funds (38 percent), ease of use (35 percent) and better rewards (25 percent). Renovating homeowners chose credit cards with promotional no- or low-interest rates for a lower cost option (44 percent), ease of use (28 percent) and a longer payoff period (24 percent), according to the Houzz and Synchrony study.

In contrast with homeowners who used credit cards, those who used secured financing to pay for their renovations commonly funded the majority of their project (50 to 74 percent was typical) with a secured loan and then covered the rest with cash or other payment methods, according to the Houzz and Bank of America study. Homeowners spending $50,000 or more on their renovations in 2017 were three times more likely to pay for their projects through secured financing, compared with those spending $5,000 to $14,999.

Gen Xers (ages 35 to 54) were more likely to finance renovations with a secured loan than other age groups.

Among those spending $50,000 to $200,000 on renovations, 15 percent used HELOCs to pay for at least part of their projects, according to the study.

Those who chose HELOCs cited ease of use, lower cost option and quicker access to funds as top motivators for using this financing method. Those who chose cash-out refinancing said low costs were by far the greatest motivation.

Nearly one-third of homeowners who paid for their 2017 renovations with secured financing (of any kind) planned to take six years or more to pay off their loan balances. As with credit card financing, more than half of all secured financing borrowers took advantage of promotional no- or low-interest rates.

The 2018 Role of Secured Financing in U.S. Home Improvement report from Houzz and Bank of America includes responses from 10,301 homeowners who renovated their primary homes in 2017 and paid with secured financing. The 2018 Role of Credit Cards in U.S. Home Improvement study from Houzz and Synchrony includes responses from 10,602 homeowners who paid for their 2017 renovations with one or more credit cards.

More on Houzz

How Much Does It Cost to Hire an Interior Designer?

Browse photos for renovation inspiration

Find a pro near you to work with